An excerpt of the book IN BANKS WE TRUST by Penny Lernoux

Anchor Press/Doubleday, 1984 - hardcover

from pages xvi - xxiv

BERTOLT BRECHT, The Threepenny Opera

In 1980 a newspaper editor asked me to write a series of investigative

articles on the impact made by the large U.S. banks on developing

countries. The idea of researching so esoteric a subject was

daunting, since, like most people, I assumed that only financial

wizards could understand the complexities of banking. Still,

any moderately informed observer could see the connection between

foreign debt and rising social discontent in areas like Latin

America, and bank experts could explain the financial puzzles—even

to a neophyte like me.

The first stage of the investigation

led to New York and Washington, D.C., where I made several discoveries,

the most important being that there is no such thing as a bachelor's

or a master's degree in banking. For the most part, banks hire

liberal arts graduates who learn banking on the job. And many

of the people who buy or found banks have had no experience in

banking at all. If they can learn it, so can we.

The second discovery was that all sorts

of hanky-panky had been going on in U.S. banks, and that several

pillars of the U.S. financial community had been near collapse

in the mid-1970s. During a meeting with a congressional staffer

who was an expert on banking, I had with me a copy of The

Crash of 79, a romantic thriller about the follies of international

bankers, written by former banker Paul E. Erdman. "You think

that's fiction," the staffer laughed. "Look at this

page about huge real estate losses. Erdman was talking about

Chase Manhattan and Citibank." Many more such revelations

followed during my weeks in Washington, by the end of which it

seemed clear that the facts were more startling than any fiction.

Congressmen, their aides, economists,

and even some bank regulators all made the same point: Because

of the pressure for growth and profits, traditional guidelines

for prudence and integrity in banking had been discarded as "old-fashioned"

and "stodgy," and rewards and promotions were going

to aggressive executives who turned out the most loans—regardless

of whether they would ever be repaid. Nor were they particular

about their clients or meticulous in their conduct of the bank's

business, whether within the law or not. Evading the law had

become common practice, and those who protested were fired for

incompetence or "mental illness," or just shelved for

lack of initiative.

During the 1970s, when the United States

and world economies were still experiencing growth, few questioned

such shoddy practices because on paper the profits looked so

handsome. But when the new decade opened on a world recession,

the dangers of speculating struck home, with huge bank losses

resulting when hustlers failed to take even minimal precautions.

Several Congressmen complained to me that they suspected some

banks, in order to gamble for higher profits, were deliberately

evading U.S. regulations designed to insure the safety of depositors.

If they lose, predicted Congressman James Leach (R-lowa), "the

buck stops with the taxpayers." Two years later, when the

Reagan administration was bailing out U.S. banks that had lent

excessively to Mexico and Brazil, bankers brusquely informed

the American public that taxpayers had no choice but to pay.

U.S. bankers are not interested in economic and political conditions

or whether a country can repay, a staff member of the Senate

Subcommittee on Foreign Economic Policy had told me. "Their

bottom line is the U.S. Treasury."

The Washington experience sharply shifted

the direction of the investigation: Obviously a lot of wheeler-dealers

were being attracted to the profession, much as gamblers are

lured to Las Vegas, but with far less risk. A gambler who fails

to pay his debts in Vegas' casinos may end up in jail or the

morgue. But a banker who gambles his institution's stability

through reckless loans can expect no more than a slap on the

wrist from U.S. bank regulators; he may even be promoted for

his recklessness!

Criminal investigators repeatedly told

me that, contrary to popular belief, white-collar crime is not

victimless since somebody always pays (viz. the taxpayer in the

bank bailout). Another frequent observation was that such misbehavior

often opens the door to organized crime. Living in Colombia,

the narcotics supermarket for the United States, I could see

how a banker who started out by cutting corners might end up

with a highly questionable clientele, including mobsters and

drug traffickers. It was common knowledge that several banks

in Colombia laundered drug money for a fee. The drug trail led

all over the world, from the Caribbean to Miami, Australia, and

eventually, to the Vatican, but the faces soon became familiar—mobsters,

right-wing terrorists, and CIA agents, all of whom used the same

banks and bankers. As one private investigator explained to me,

it is not surprising that the Mob prefers a bank patronized by

the CIA, since both are involved in illegal activities, only

the CIA calls its work covert action. Any bank that serves the

CIA by funneling agency money into covert work must hide the

trail through paper fronts, and such fronts are precisely what

organized crime needs to wash its dirty money. It also became

apparent that some bankers deliberately blurred their relations

with government agents and mobsters, using a CIA cover to protect

their criminal connections. But in a number of cases it was not

only the banker who clouded the lines but also the CIA, which

was working with gangsters, supposedly for political motives

but occasionally for the personal enrichment of its agents, as

appears to have been the case in the Nugan Hand Bank scandal

in Australia.

Two questions arose from such connections.

Why was the CIA working with gangsters and drug traffickers?

And how did banks fit into the picture? The answer to the former

can be traced back to World War II, when ties between organized

crime and the CIA's predecessor were first forged, and, more

recently, to the cold war, when the anti-Communist imperative

led the CIA to take an active role in promoting Southeast Asia's

heroin trade. After the ClA's disastrous experience at the Bay

of Pigs in 1961, a number of agents turned to the cocaine and

marijuana trade, and the South American drug traffic was also

politicized, with militant anticommunism—or just plain terrorism—serving

as cover for the trade.

The answer to the second question lies

in the changed nature of banking and the size of criminal profits.

In the past mobsters infiltrated many industries but rarely bothered

with banks because they were not spectacularly profitable and

were conservatively run. Moreover, the underground economy was

still limited in size and had no overwhelming need of banks.

All that has changed since the 1970s, with the exponential growth

of money markets and a parallel explosion in profits from crime,

particularly the drug trade, which earns more than $79 billion

a year in untaxed profits and ranks as the United States' second

biggest industry after oil. Today banks are an essential cog

in criminal industries, serving to launder dirty money and finance

new enterprises and for related activities in the securities,

commodity, and stock markets. Such is the wheeler-dealer atmosphere

in banking that even the most venerable institutions have been

touched by scandal. They include the Vatican Bank, which has

been implicated in a $1.4 billion fraud.

This book follows the same pattern

of discovery that the investigation took, first describing the

follies and dubious shenanigans of several large U.S. banks.

The people involved are not necessarily criminals, although convictions

may arise from one case. Rather, they are what is loosely described

in business journals as wheeler-dealers—people who skirt

the law or take big risks for quick profits. Some were plain

dumb, in the words of a bank chairman involved in the Penn Square

debacle, believing that there was such a thing as a sure gamble,

only to discover, when the chips were down, that potential profits

must be weighed against the danger of loss. Curiously, while

malevolent, the criminal element poses less of a threat to the

average American than the wheeler-dealers, who, as happened in

1929, could bring the economy crashing down. Indeed, it is the

"anything goes" atmosphere in banking today—along

with huge profits and virtually no government controls—that

has attracted so many crooks.

The second part of the book documents

the criminal aspects of banking, showing how gangsters and U.S.

intelligence agents have used the same banks. The Latin-American

and Caribbean connections, particularly in the chapters on the

Vatican Bank, relate right-wing terrorists to bank involvement

in the U.S.-bound narcotics traffic, two thirds of which originates

in Latin America.

The third part also focuses on Latin

America because of bankers' fears that a string of Latin defaults

could end in a replay of the 1929 bank crash. Latin America also

offers a good example of how human rights in the developing countries

are linked to American pocketbooks. By so enmeshing their financial

futures with Latin America, U.S. banks have probably done more

than any human rights organization to heighten Americans' awareness

of their neighbors' plight.

Throughout the book there is a recurrent

theme: the complacency in American society that tolerates—even

admires—Mafia gangsters and the successful operator who

makes a killing by bending the law. Or, as one criminal investigator

put it, "It's time we Americans recognized that the idea

that crime doesn't pay is pure nonsense. Crime pays more than

any other profession, with less risk and a higher profit motive."

Especially for banks.

PART I

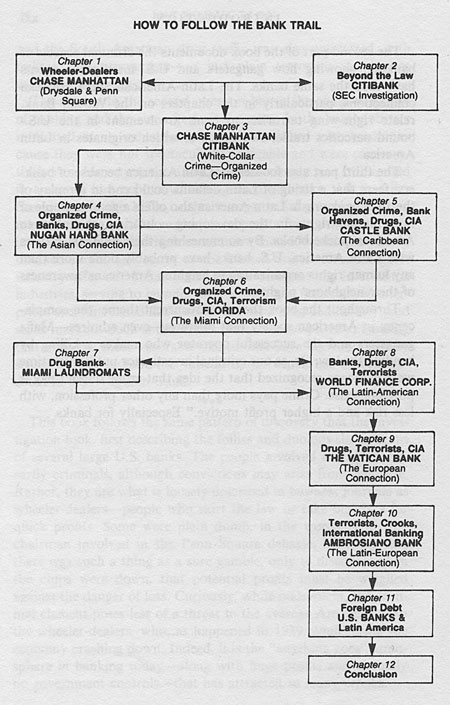

CHAPTER I describes how Chase Manhattan, through loose management, lost $542 million on a securities gamble and a high-flying bank in an Oklahoma shopping center. Supporting cast: Continental Illinois and Seattle-First National.

CHAPTER 2 documents how such disasters occur through lax regulation and auditing procedures encouraged by "bank reserve," and how such "reserve" enabled Citibank to evade tax and prudential regulations, as revealed by the shocking results of a three-year Securities and Exchange Commission investigation.

CHAPTER 3 links Chase's loose management and Citibank's failure to check employees' backgrounds to the $20.3 million "Outrigger" real estate seam involving organized-crime figures.

PART II

CHAPTER 4 reveals how a Sydney merchant bank became the fulcrum for organized crime, covert action, and the politics of heroin in Southeast Asia. Cast includes a Who's Who of the CIA.

CHAPTER 5 connects Southeast Asian heroin traffic, the CIA, and organized crime in Caribbean bank havens.

CHAPTER 6 shows how Miami has become a center for "hot" money, drugs, and international intrigue.

CHAPTER 7 names Miami banks in drug traffic and explains money laundering and regulators' failure to stop it.

CHAPTER 8 tells of the rise and fall of an international laundromat with CIA, drug, terrorist, and organized-crime connections.

CHAPTER 9 documents the links among European and Latin-American fascists and Nazis, the cocaine traffic, organized crime, and the Vatican Bank.

CHAPTER 10 examines the "suicide" of Italian banker

Roberto Calvi and his fascist and Vatican connections, and how

the Vatican Bank's failure to honor its debts threw a monkey

wrench into the Eurocurrency market.

PART III

CHAPTER 11 relates how the wheeler-dealer atmosphere in banking led to a gambling spree by U.S. banks in Latin America and tells of the Great Bank Bailout.

CHAPTER 12 concludes with some questions and answers.

Home